Crypto Tax Prep

Our goal is to make the crypto tax filing process as simple as possible.

The Deliverable

Here’s what you get.

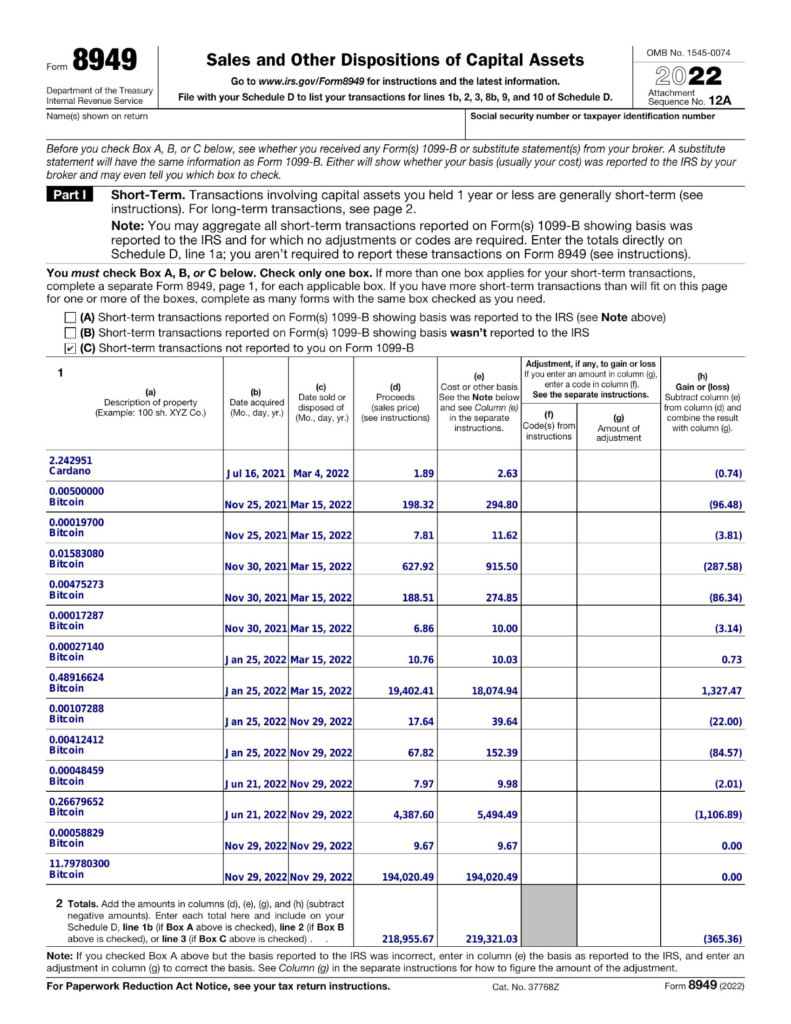

Summary Report

Summarizes your gains, losses, income, and deductions for the requested time period. By itself, this report is sufficient evidence to corroborate most tax forms.

Download example of Summary Report

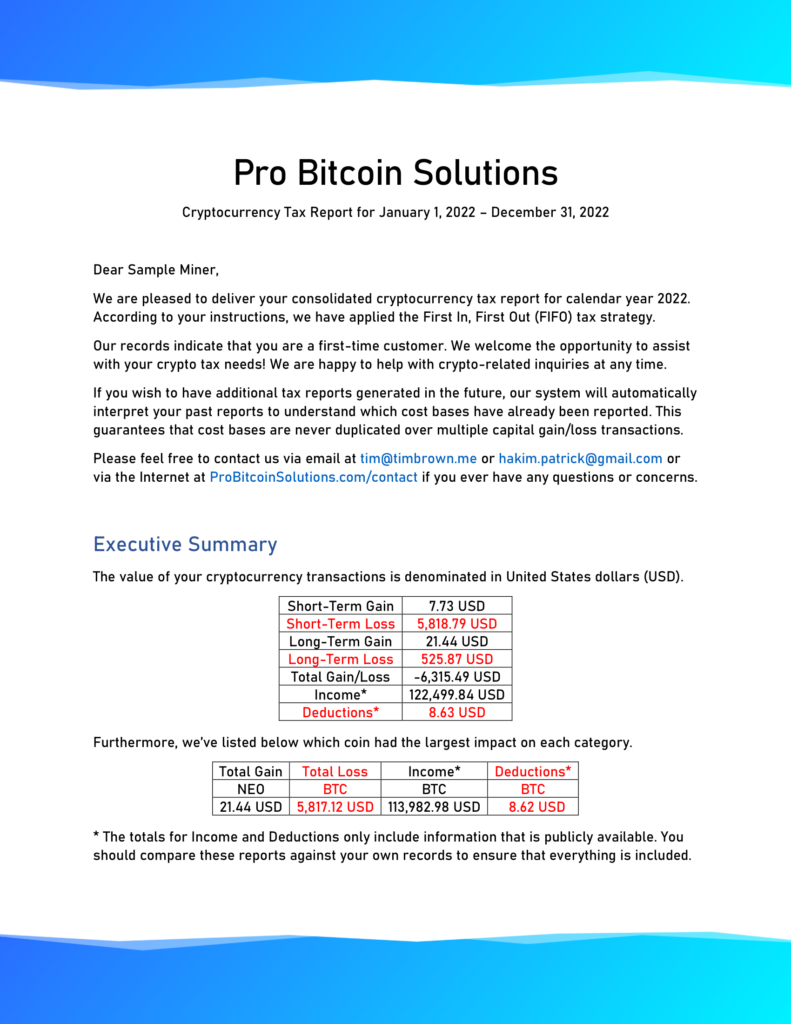

Detailed Report

Lists your realized capital gains, realized capital losses, income, and deductions. Each row includes relevant timestamps, exchange rates, and other calculations.

Download example of Detailed Report

Which coins are supported?

Our blockchain indexer supports more than 600 different coins, and we are constantly adding new ones in response to our clients’ needs.

Bitcoin

Ethereum

Tether

BNB

USD Coin

XRP

BUSD

Cardano

Dogecoin

Polygon

Solana

Polkadot

Litecoin

Avalanche

Shiba Inu

Tron

Dai

Uniswap

and 643 others…

Which coins are not supported?

We don’t support LP tokens due to the price uncertainty caused by impermanent loss.

There are also some regular coins which we don’t support for various reasons, as shown below:

BlackFisk

COIN

ECOMI

Stacks

TBB

Zcash

Creditum

Download Sample Reports

Sample delivery package for a cryptocurrency miner and staker:

Invoice (full price) / Summary Report / Detailed Report

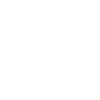

Form 8949 for Short-Term & Long-Term Gains (US taxpayers only)